Return Inwards in Trial Balance

5 Is return inwards debit or credit in trial balance. Return Inward in the Trial Balance are deducted from A.

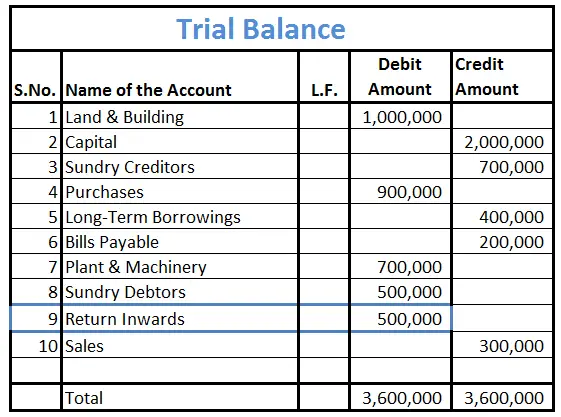

How Is Return Inwards Treated In Trial Balance Accounting Capital

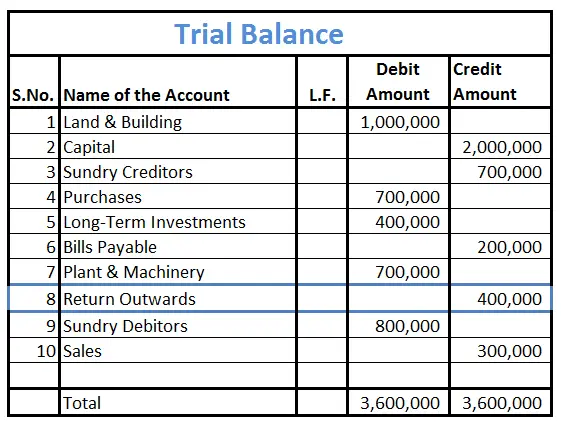

Return outwards holds credit balance and is placed on the credit side of the trial balance.

. 6 How is carriage inwards recorded in final accounts. It is treated as. The treatment of return outward in trial balance is to debit the account and credit the related revenue account.

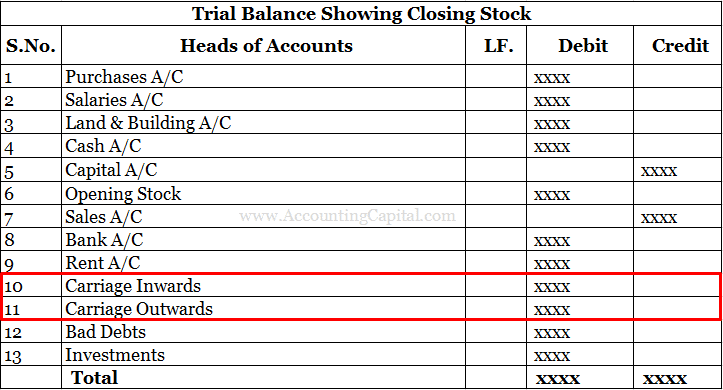

Carriage inwards in trial balance and Carriage outwards in trial balance are both treated as just another expense. Return outwards is recorded in the books of accounts of the buyer. This flow of goods is deducted from the sale balance to determine the firms actual position.

Return outwards is also known as purchase returns. What is return outward in trial balance. This ensures that the net income of the company is accurate and reflects all.

So they contact the. The Carriage Inwards can be found as an asset in the Balance. Wages and Salaries Rent.

Return Inwards appearing in Trial Balance are deducted from. A trial balance is prepared to check the arithmetical accuracy of the double entries made in the ledger and as a basis to prepare financial statements. The entries about the freight.

Where does return outwards go in balance sheet. 415 57 votes. Return inwards is the flow of goods in the business which were sold.

May 11 2022 What are Returns Inwards and Returns Outwards. It is deducted from the sales balance to show the actual position of the firm and deduct the amount which is returned as it is. Return Inwards appearing in Trial balance are deducted from_____.

The amount of return outwards or purchase returns is deducted from the total purchases of the firm. A Purchases B Sales C Returns Outwards D Capital Medium Solution Verified by Toppr Correct option is B Return inwards is. ABC company sells 10000 units of goods at 10 per unit to the customer on credit.

The amount of return inwards or sales returns is deducted from the total sales. Return inwards is recorded in the books of accounts of the seller. It is deducted from the sales balance to show the actual position of the firm and deduct the.

Is carriage outward DR or CR. After the delivery the customer found out that they are the wrong products. In business return inwards means a businesss return of sold goods.

Is return inwards debit or credit in trial balanceReturn inwards is also known as sales returns. Returns inwards are goods returned to the selling entity by the customer such as for warranty claims or. Correct option is B Return inwards is the flow of goods in the business which were sold.

How Is Return Inwards Treated In Trial Balance Accounting Capital

Carriage Outwards Carriage Inwards In Trial Balance Accounting Capital

How Is Return Outwards Treated In Trial Balance Accounting Capital

What Are Return Inwards Example Journal Entry Accounting Capital

No comments for "Return Inwards in Trial Balance"

Post a Comment